The Late Payment of Commercial Debts Regulations 2013

In these economically challenging times, businesses, especially those in the construction sector, need all the help they can get in encouraging prompt payment and aiding cash flow. Indeed poor payment practices, rife in the construction industry, blighted many businesses and contributed to the introduction of the Housing Grants Construction and Regeneration Act 1996 (HGCRA). Now, further help is at hand in the form of the Late Payment of Commercial Debts Regulations 2013.

The Regulations are aimed at combating late payments in commercial transactions, and came into force on 16 March 2013. They apply to commercial contracts in England, Wales and Northern Ireland (they came into force separately in Scotland on 29 April 2013). They do not have retrospective effect so do not apply to contracts entered into before these dates.

The legislation is intended to bolster the protection already afforded to business by the Late Payment of Commercial Debts (Interest) Act 1998 (the Act). The Act provides for simple interest to be payable on outstanding debts at a penal rate of 8% above the Bank of England base rate.

The Regulations apply to all businesses, including small businesses and public authorities.

Research undertaken across the EU indicates that the culture of late payment is still the scourge of small and medium sized businesses and this detrimentally affects cashflow, damages business confidence thereby impacting on investment decisions and can in the worst case lead to insolvencies. The current Regulations were enacted to further discourage late payment and to bring UK legislation in the into line with the EU.

The Regulations amend the Act by imposing limits on payment periods of:

- 30 calendar days when the purchaser of goods/services is a public authority;

- 60 calendar days when the purchaser is another business, but this can be extended if expressly agreed in the contract and provided it is not grossly unfair to the supplier.

The Regulations also:

- impose a limit of not more than 30 calendar days (before the payment period begins) for the purchaser to verify the conformity of goods/services are in accordance with the contract - but this period can be exceeded by agreement and provided it is not grossly unfair to the supplier.

- allow the supplier compensation for its reasonable costs of debt recovery above the fixed costs currently recoverable under the Act (£40 for debts of under £1,000, £70 for debts of under £10,000 and £100 for debts over £10,000).

The reference to ‘grossly unfair’ requires a consideration of all the circumstances of the case including anything that is a gross deviation from good commercial practice and contrary to good faith and fair dealing and considering the nature of the goods and services in question.

Interestingly, the HGCRA does not stipulate payment periods, simply providing that parties are free to agree what payments are due and when, ie, the contract must set out an adequate mechanism for determining these matters. In default the Scheme for Construction Contracts applies providing a payment period of 17 days from the due date to the final date for payment.

Whilst it is crucial for businesses to have written terms of trade for clarity and certainty, support from the Regulations is certainly welcome particularly for those small to medium sized businesses which make up a large proportion of UK business struggling to survive in these harsh economic conditions.

[edit] Related articles on Designing Buildings Wiki

- Construction supply chain payment charter.

- Fair payment practices.

- Housing Grants, Construction and Regeneration Act.

- Insolvency.

- Late payment.

- Payment notice.

- Payment period.

- Remedies for late payment.

- Scheme for construction contracts.

- Small Business, Enterprise and Employment Bill.

- The causes of late payment in construction.

[edit] External references

Featured articles and news

How can digital twins boost profitability within construction?

A brief description of a smart construction dashboard, collecting as-built data, as a s site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure bill oulined

With reactions from IHBC and others on its potential impacts.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

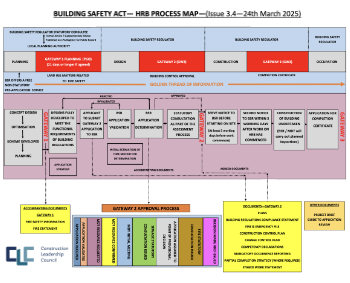

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.